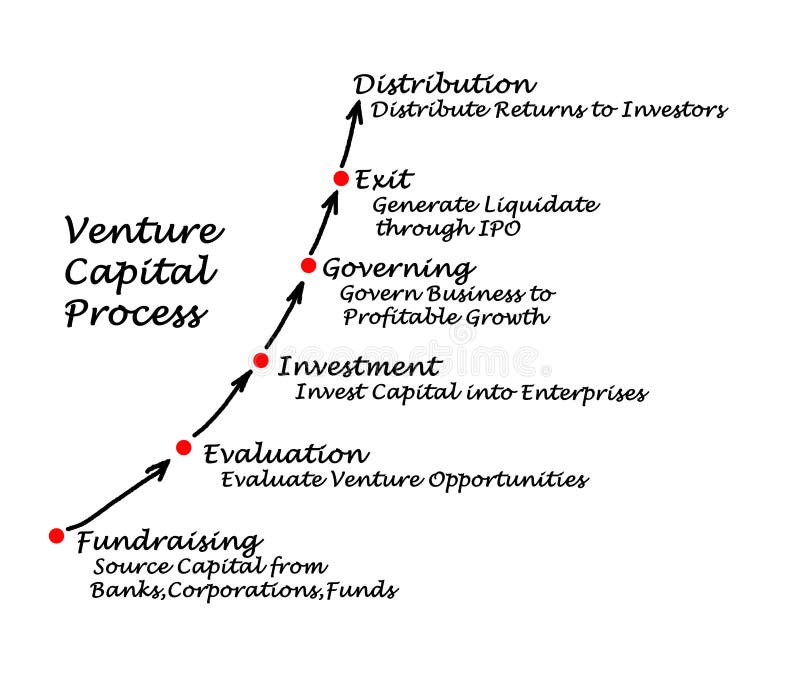

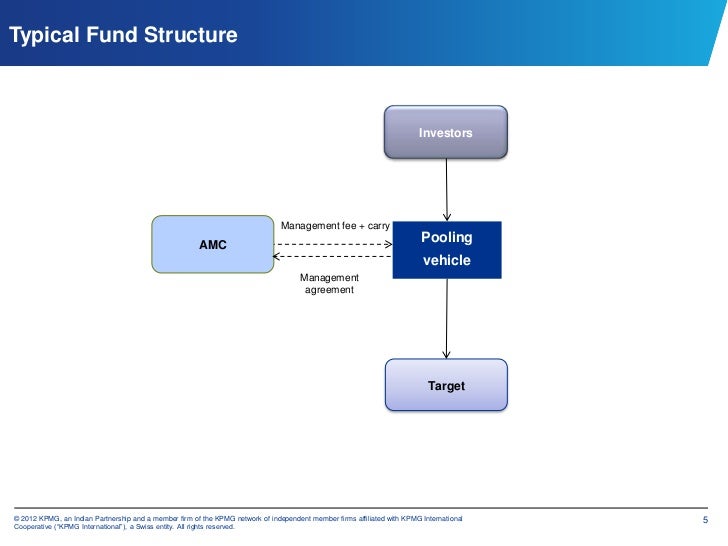

The best models for venture funds are built with the intent of reflecting their investment strategies. Contact me if you have questions on modeling alternative venture structures. For this post, we will focus on closed-ended venture funds making investments into equity or equity-like structures (convertible notes, SAFEs, SAFTs, and other token structures). Open-ended venture funds, evergreen funds, venture debt, revenue-sharing venture funds, and fund of funds share many similarities regarding capital budgeting and deployment, but often differ in the timing and nature of proceeds and recycling. Similarly, hedge funds have different structures and expectations around investment and limited partner liquidity, making them substantially different from venture funds. Private equity funds and real estate investment funds often have fund structures and expectations in how and when proceeds are received that differ substantially from venture capital funds. Modeling a venture fund can vary from modeling other types of private equity investments.

#Venture capital fund structure how to#

For background on that topic, I’ve written a post for AngelList, How to Make a Budget for a Rolling Fund that provides advice that’s comparable for modeling management companies managing any type of fund. This post will focus on creating a model for a fund, not for the management company. to create a forecast of cash flows and financials. Modeling the management company is similar to modeling any operating company, and typically consists of modeling revenues - primarily management fees from the fund(s) - and expenses - salaries, overhead, legal, accounting, travel, etc.

As a prospective or emerging fund manager, you will spend most of your time crafting your investment thesis, and detailing how and why founders and investors should work with you, towards creating a point of view on how you will create a successful venture fund.Ĭreating a financial model for your fund allows you to detail your thesis and strategy in quantitative terms, to create some expectations for how you will spend your investors’ capital and generate returns on your investments.

0 kommentar(er)

0 kommentar(er)